Liberty News - This is how expensive Swiss pension apps are

Pension apps are significantly cheaper than most pension funds. However, there are big differences. LibertyGreen is one of the most affordable providers with its 3rd pillar pension app.

For several years now, pension apps have been among the most successful innovations in the Swiss financial sector. Swiss clients have already invested well over 4 billion Swiss francs into private pensionsvia apps, as the online comparison service moneyland.ch has revealed. This shows that pillar 3a solutions are becoming increasingly digital. In addition, some apps for the second pillar (vested benefits) are also available.

Apps are more cost-effective than traditional pension fund

solutions

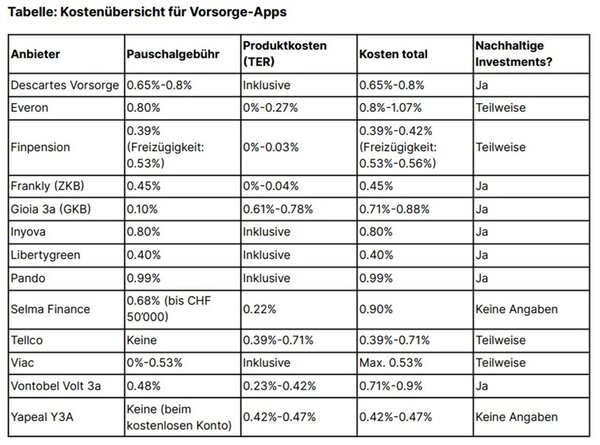

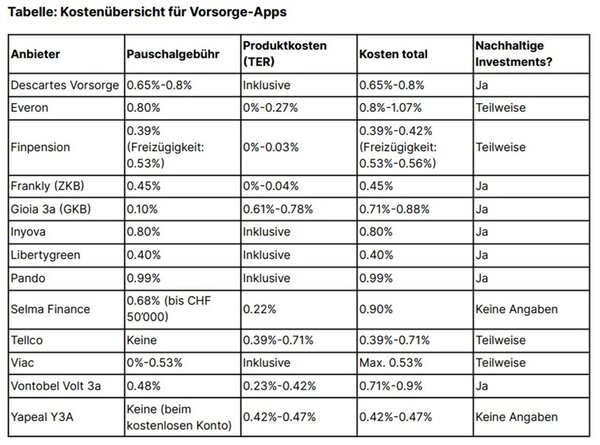

As with digital asset managers, the costs of pension apps are essentially made up of two components: flat fees and product costs. Some apps include the product costs in their flat fees. Other apps do the opposite and only charge the product costs. Therefore, both types of fees should always be considered. Depending on the selected investment strategy, fees may vary with some apps.

The costs of pension apps range from 0.39% to a maximum of 1.07% per year. Compared to classic pension funds, this is significantly cheaper: on average, classic pension funds cost more than 1% per year. "However, there are individual pension funds that can be as inexpensive as pension apps - so a comparison is still recommended," emphasizes Benjamin Manz, CEO of moneyland.ch.

There are a few criteria to consider when choosing

Cost is one of the most important criteria when choosing the right retirement planning app. However, there are other selection criteria. These include the financial products used, the user-friendliness of the app, and customer service in the event of any problems. Regarding the user-friendliness of the app, it can be worthwhile to study the apps and their respective customer reviews in advance. Those who value sustainable investing can limit their selection to sustainable solutions.

How sustainable are pension apps?

Apps that primarily utilize sustainable investments include Descartes Vorsorge, Frankly, Gioia, Inyova, LibertyGreen, Pando and Vontobel Volt 3a. Other apps, such as Finpension, Tellco and Viac, at least allow sustainable products to be selected. Most app solutions follow the common ESG criteria (environmental, social and corporate governance).

However, ESG criterias are not yet uniformly regulated. Manz is also aware of this: "There are always legitimate discussions about how sustainable these criteria really are. But the sustainability criteria applied by Swiss pension apps are at least a start. "

Pillar 3a: Equity solution or savings account?

Pension apps invest primarily in equities and asset classes - often indirectly via exchange-traded funds (ETFs). As with all equity investments, the investment horizon should therefore be long-term - ideally at least eight to ten years. In between, there may well be years with losses. "Anyone who cannot sleep soundly because of possible losses should opt for a conservative 3a savings account," advises Manz. He adds, "There is less interest in the long term, but no losses. "

Source: moneyland.ch; Status: October 2022